Newsletter - 04/21/2024

UPCOMING WEEK:

Well we are at the breaking point. The sheer amount of bad news: interest rates, Middle East, inflation - you name it and there was probably bad news about it this past week. Does this mean the market will go straight down? Of course not.

But to me it does mean that the easy money to the topside is done. I sense a change in the overall market tone from willful ignorance (AI boom) to where we are today: growing resignation that things are going to get worse. The next step is when the dam breaks and investors just want out.

Week in Review

From TRowePrice:

"Stocks recorded their third consecutive week of broad losses, as concerns over tensions in the Middle East and the possibility of U.S. interest rates remaining “higher for longer” appeared to weigh on sentiment. Mega-cap technology shares lagged as rising rates placed a higher theoretical discount on future earnings. A first-quarter revenue miss from advanced chipmaker supplier ASML Holdings also seemed to weigh on the sector and on general optimism toward companies with artificial intelligence (AI)-related earnings, according to T. Rowe Price traders. Small-caps continued to struggle, pushing the small-cap Russell 2000 Index further into negative territory for the year-to-date period.

The trading week started off on a strong note, which our traders believed to be driven by relief that Iran’s well-telegraphed retaliatory strike on Israel did not result in worst-case scenarios, with nearly all missiles fired into the country intercepted by air defenses. However, hopes that Israel would carry out a measured response faded alongside stock prices as reports surfaced that the Israeli war cabinet had decided to retaliate “clearly and forcefully.” On Friday, stocks headed lower again, after Israel conducted strikes on air defense facilities within Iran, as well as on Iran-backed groups in Iran and Iraq (see below).

Some strong economic data appeared to increase worries that the Federal Reserve would push back any interest rates cuts to the fall, if not to 2025. On Monday, the Commerce Department reported that retail sales rose 0.7% in March, well above consensus expectations of around 0.3%, while February’s gain was revised upward to 0.9%. Rising gas prices were partly at work (the data are not adjusted for inflation), but the strength was broad-based and included healthy gains in discretionary categories, such as restaurants and bars and online retailers.

As was the case the previous week, Fed officials expressed their concern with recent economic data. On Tuesday, Fed Chair Jerome Powell stated at an economic conference that “recent data have clearly not given us greater confidence and instead indicate that it’s likely to take longer than expected to achieve that confidence.” On Thursday, New York Fed President John Williams warned that a rate hike is not the baseline, but that one is possible if the data warrants. Atlanta Fed President Raphael Bostic said that policymakers would not be in a position to cut rates until the end of the year.

The retail sales data helped push the yield on the benchmark 10-year U.S. Treasury note to its highest intraday level since early November. (Bond prices and yields move in opposite directions.) Municipal bond yields also increased in the first half of the week alongside a flood of new issuance, but they held in well relative to Treasuries later in the week as most of the new deals were met with strong demand.

In the investment-grade corporate bond market, issuance was relatively light but met expectations, and most issues were oversubscribed. However, the higher-for-longer rates narrative and geopolitical tensions weighed on the high yield bond market, and our traders noted that trade volumes were somewhat above average as more sellers appeared to be active and high yield funds industrywide reported negative flows."

Sectors

SPX and NDX

The market was brutal this week as Tech sold off leading a persistent downturn in all stocks. Technically a great deal of damage has been done that now has to be dealt with BEFORE the market can go higher. First up is reclaiming 5000 SPX. Then its reclaiming just the 5dma. Rips will be sold - bulls will still try but their failure just got a lot closer.

The weekly SPX is ugly. Huge red candle and a close at the lows and below 5000. I do expect a retrace up to the 5050 level but not much more. I think the lows will be tested next week and there is no reason to believe that this coming week will be green.

NDX:

NDX broke moderate support at the 17281ish level and never looked back. As with the SPX, serious technical damage has been done on the daily and the weekly. What was possible a consolidation period before the next move higher has now turned into the beginnings of sell the rips.

We should see a bounce of up to 50% of last week's move making the setup a "Bull Trap". Only a close above last weeks high will cause me to consider to add more longs.

Small caps MAY have bottomed but until a reversal is confirmed, the trend is down. I believe we might have seen the highs in small caps for the year since they already had lagged the SPX and NDX. Also, the were not able to break out and hold. We shall see if selling (lower chart section, green bars) continues to increase or not.

Fund Flows

Well that's not surprising - no positive money flow into risk assets. What IS surprising is the amount that flowed out of money markets. Some of it, a small amount of it could of been for taxes but that tells me one important data point: liquidity, the Bulls' ace in the hole, is leaving the market.

As for the sectors, Healthcare continues to be sold. It might be a preparation for a possible Trump victory but that is the only reason I can come up with that makes sense.

Bitcoin & Miners

BTC is stuck. It is moves similarly to small caps and suffered the same price drop. BUT. It uncorrelated to stock the last part of the week, probably due to the halving. Even the Thursday night Middle East did not see BTC as the choice for flight to safety.

IREN had four very strong days in a row after dropping with the overall market on Monday. It bounced at a moderate support level (4.20 area) and is up over 80% since. Now with the halving out of the way, we will get a good idea how the miners will be traded - as a group or individually.

CIFR rallied also, albeit for only three days to IREN's four. POC is supportive right below the reversal area and there's even some buying by institutions starting (red bar, bottom graph), Time to see how it's going to trade post halving.

Price has broke below $2 but I can't add more until the halving is over. The break through the $1.92 support was very strong but I do believe we could get a bounce this week - if not I will look to exit or roll.

BITO is suffering from decay due to it's structure. I will look to replace it with something next. I was hoping we would have options on the BTC ETFs by now but since we do not, I will see if there is anything else better that I can own to give me exposure.

Now that the halving is out of the way, we will see if BTC and miners have the same price movement as the previous two halvings: hockey stick up. They could be the "hot" sector in a down market. Or, they could continue to fall as investors decide to make their move to the BTC ETFs permanent. I am looking to this week to give me a clue as to what the early tone will be.

Doom Trades

$KRE

Price actually closed below my break level BUT it did not close below on the weekly chart, the chart I use for catching true early trend changes. We are in the thick of regional bank earnings and thus far, they haven't signaled that the Armageddon in CRE is reflecting yet. Their outlooks have been bad, just not bad enough. And of course, I think they are lying until it becomes a material event.

$VNQ

I was able to get in before VNQ really started dropping this week as last week's close below the 81.56 break level was confirmed. I don't care what the REITs report, this is an easy trade to make. I fully expect to get at least a 5x out of this trade by February 2025.

$BAC:

Well that happened quickly. One week the DOOM Trade is confirmed and the next it is cancelled. This next week is the deciding week for a direction over the next 30 days.

$TQQQ:

I did get short this Friday morning as part of my entry into the trade contest.

$HYG:

Last week's break also confirmed but price did bounce at the 75.56 minor support level. Next week we will see if it can punch through.

Current Open Positions

$CFLT:

CFLT broke support of 29.22 and has not looked back. I had a total brain fart and used July calls instead of June. Duh. Still, trade is up 25% and I will look to scale next week.

$PENN:

Price invalidated the trade on Friday so unless we get a reversal, I will be out of this trade on Monday with a small 15% percent loss. The fact that it was so strong on Friday with the rest of the market so weak does give me pause. But I see no institutional buying at all so while the selling is persistent, downward momentum is dying.

$DNUT:

Trend remains down but Friday printed a hammer doji. If it reverses on Monday I will take the stop for a break even trade.

Closed Positions

$AAPL:

Stupid news release Sunday night hosed the lotto trade. I closed it Monday for a small 35% loss. Thank full I did and didn't allow myself to have hopium that "maybe it would go back up."

Doom Update

DOOM 1: CRE IMPLODES

I could keep posting about falling values, falling cash flow but that's boring. How about this gem to the left? This guy is probably a savant. For real. So when he says banks are also experiencing stress from residential multi-family . . . well that's even worse!

Look - IT DOES NOT MATTER! THERE IS NOTHING THAT WILL SAVE CRE EXCEPT A BAILOUT. PERIOD.

This is a fat pitch situation. What's going to save them? The regionals? Anyone? I am being dead serious. Other than what I mentioned above, what is going to save them?

Exactly.

Also, who the f is using the Discount Window? How much are they using it for and which banks? We will get that info in a couple of weeks. Then we will see how strong the stock prices are.

I had better never hear a member say "Why didn't I see that?" I will immediately ban them. If you don't want to risk money that's fine but if you don't see how bad it is and it is GETTING then why are you in my Discord?

The next picture is just an example of the "class" of properties that are failing: A Class. The best, the newest, the most well funded. Get it? Got it? GOOD!

DOOM 2: JAPAN GOES FULL KICHIGAI

Really there was no news this other than the fact that there is no intelligent person in the world that takes the JCB seriously.

150 IS THE LINE IN THE SAND!

wait.. . . 151 IS THE LINE IN THE SAND!

no . . . uhm 152 IS THE line in the sand. .

wait its now 153.

15. . . .f' it - the line is 160.

DOOM 3: GAZA EXPANDS

So that happened. Of course I am sure you know what I am talking about: perhaps the most "wag toe Dog" war I have ever seen. First, let's answer a couple of questions:

- Was this planned to occur when the market is closed? Cmon. Really? Of course it was.

- Was Israel just testing the Iranian air defenses and gathering real time data? They have done this before so it is a possibility, not a probability.

- Is the war over? Are you kidding me???

This is not just "a war." This is a battle for existence. Israel knows that they could soon be surrounded by nuclear neighbors. Each who would like nothing more than to wipe Israel off the map. This battle is over 4000 years old.

The geopolitical risk is higher than I have ever experienced before. The risk of one of the numerous actors involved deciding to "go off script" is rising. The mere fact I have to now consider, no matter how small, a nuclear exchange in the Middle East within the next 12 months; it's a LOW probability that it shouldn't even BE a possibility.

And it is the flashpoint for the greater battle that is happening globally as predominately Muslim military aged men are committing random attacks of violence: it is a battle for Western Civilization. I am not engaging in hyperbole. Those young men are not here and globally because they want peace. They want subjugation. If you haven't realized this yet you are willfully being ignorant of the facts.

BACK TO DOOM 1: CRE IMPLODES

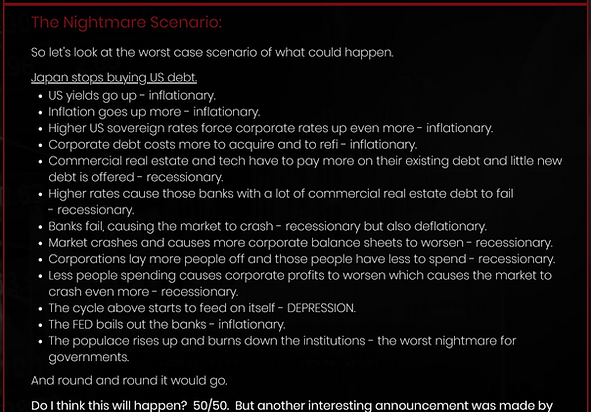

Well after that wonderfully uplifting comment, let's get to more gloom and doom. The following are in response to the question I am asked: "How bad could it get?" This was from an early newsletter of mine.

Answering the followup question, "What would it look like when it's happening?":

Finally, let's add some insult to injury. Here's how much these geniuses lost in 2023:

Board Meeting

Ok, I'd like to take the time to discuss our Discord chat. First, thank you to all who are part of it and for those who are not, you really should check it out. Its a group of smart, passionate investors and traders helping each other learn. (Click here to visit)

I wanted to encourage members to continue to share your trade ideas as long as they included a thesis and relevant price data. It doesn't have to be a real trade but don't try to pass a paper trade idea for a real trade idea. Instant ban. Also, I want to remind members that we are not a day trading room. What I mean is I do not want ideas posted that are a day trade. Yes, once in awhile I will share that I am scalping the SPY - but that's me. I mean this completely respectfully, but I get to post bc I have experience doing it. This includes pre-market gap up plays.

I remained committed to making sure our Discord is a place where we discuss high probability trade ideas. Getting into a scalp bc a stock has gapped before the open is not. AND I AM NOT CALLING ANYONE OUT because I am not upset. This has to do with what the purpose of this Discord is. It is to be different than every other Discord out there. It is to be SUPERIOR to ever other Discord out there. Much of that is how you all conduct yourselves but a lot is also based on the topics we discuss. Trust me when I tell you this that we have VIPs that are making amounts of money in excess of a single salary and they don't share their trades - because their method is higher risk and lower probability. Thanks!

Oh, and a special thankyou and apology to @AV who's One-on-One got cancelled today.

PODCAST:

The Podcast library is here.

VIDEOS:

The Video library is here.

Paid Memberships:

Look, there are a LOT of scammers out there on FinTwit. 99.99% of them care only about selling packages of crap. SOME OF THEM ARE CHARGING AS MUCH AS $5,000 PER MONTH! None of them include what helped make me a better trader: having a mentor. Having someone who will be your PERSONAL TEACHER, COACH AND ACCOUNTABILITY PARTNER. A Mentor that has over 90,000 hours of screen time. That by itself is invaluable.

People ask why I charge. First, I want only VIPs that are committed and "having skin in the game" guarantees this. Second, because my time is valuable.

See what others are saying:

MERCH STORE IS OPEN AND LIVE!

Don't forget the Discord live chat is STILL FREE but it will be closing to new members soon. In fact, we have already started removing non-active members.

-

In the meantime, come and join us - its the best community out there: Discord.

-

Also, be sure to check out the new page for Daytrading on the website, run by the fine gents @BaconTurkeyClub and @Juggernaut. If you ever wanted to learn or just watch two pros daytrade live, they are at it every day here: DiscordFuturesChannel.

-

Finally, be sure to check out VampireTrades and his amazing penny stock trades.

Thankyou Family!

theBoss

Nothing above is investment advice nor should it be construed as investment advice. It is offerred for entertainment purposes only. Always consult your advisors before investing any money. Do not "follow" or "mirror" any trade ideas provided. Mr.NotAdvice is not a licensed or registered investment advisor. Do your own research.